-

Posts

2,746 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Gallery

Blogs

Store

Everything posted by nbfiresprite

-

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

Nouveau riche rather than Nouveaux Pauvres -

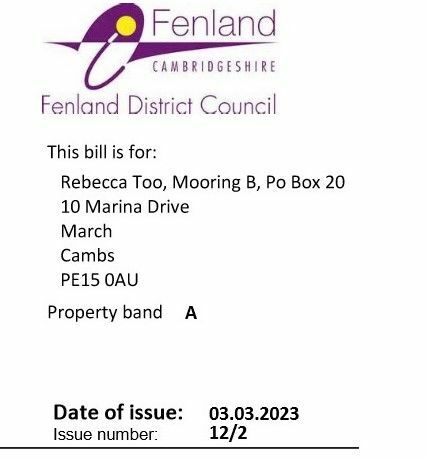

I think they did it this way to get round the fact that not the same mooring is used each time, every time the boat goes out or is moved by the marina. They are about 40 boats on mooring B (Short for mooring basin B).

-

I been fighting this for last few years, No sooner do I get it removed it is reinstated on the list within a week. Two refused to pay and were taken to the cleaners by the council, they had to sell up to pay the fines or go to the cells and still pay.

-

In our case, it was local boater hating councillor who demanded that boats should pay council tax, the same as Holiday homes. Hence the marina was ordered to hand over the details of every moorer, who were sent a letter requiring them to produce a council tax bill in their name or pay council tax on the boat and mooring. As no post is allowed I don't know where they get the PO Box number from.

-

https://publications.parliament.uk/pa/cm200102/cmselect/cmtlgr/809/809m19.htm A boat is legally a chattel. You can elect for a boat to be your main residence for income tax and, when mortgage relief was available, you could claim tax relief on the interest for a loan to buy a boat if it was your home. However, you can be made homeless if you have legal costs awarded against you because it is houses that are protected, not homes that happen to be chattels. We won't bore you with the fun and games boat dwellers have with welfare benefits as we are sure you have the imagination to envisage the difficulties when a complex system is faced with an unanticipated set of circumstances.

-

My older brother is the current Lord of the Manor, this does mean he has to pay for the upkeep of the Village Green and Village Hall. In my Great Grandfather day, the house still had domestic servants. That was until we were hit by heavy death duties when he died. Much of the Estate land had to be sold off, Some of the heathland were given to the RSPB to reduce tax. The house and remaining land is now held in a trust. Nowadays the house is rented out and we have one farmer as a tennant. The profits after costs goes in to a Trust fund for the benefit of the family members.

-

The attic is where the domestic servants lived, As for the tennants they would have their own cottages on our land.

-

Lode End Lock is a new lock built when the Pumping station was installed at the south end of Bevills Leam in 1980's. It will accommodate boats up to 20.70m (68'-0") by 3.50m (11'-6") Average depth in summer is 5ft, unless heavy rain is forecasted than the levels are lowered. This section of the old nene is the lowest navigable water in the UK, the mooring at the far end of NewDyke is only a short walk from Holme Post. Which at nine feet below sea level, it mark the lowest land point in England. Once completely buried, these improvised geographical tools became gradually exposed as the peaty earth around them sank 13 feet since 1851. Horseways Lock on the disuse Forty Foot link to the Old Bedford river is the only lock on the Middle Level that has not been rebuilt (44'x11.5')

-

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

Many boaters with shorelines have seen a far higher increase in Unit rates for electrc as their unit rate is not protected by the 'Energy Price Guarantee' which protects domestic customers accounts from increases in energy costs by limiting the amount suppliers can charge per unit of energy used (Currently 34p per KW). Some places are charging nearly 65p per unit for shorelines. The price of coal has rocketed, last spring, the local price for 25Kg sack of Burnwell was £8.50. The price now is £19.50 per 25kg, The price of gas bottles has also gone up, plus this winter they have been in short supply. The price of Diesel even now is still around £1.75. I'm only on the boat three nights a week for 42 weeks of the year, the rest of the time I'm at home in Dorset. Yet my fixed costs for the boat are higher than for my house. Licence, Mooring fees and Council tax on the mooring, I'm also paying a higher rate for electrc for the boat than I'am for my home. -

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

Have handed your rebate back? -

I did see one, about 40 years ago on the River Frome in Dorset, being tested by the Marines at Hamworthy.

-

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

https://online.apply-for-energy-bill-alternative-funds.service.gov.uk/s/#where-do-you-live -

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

Claim Portal now open for all areas -

Have you tried going direct to Lloyds of London, they should be able to help. Australia Office Suite 1603, Level 16 1 Macquarie Place Sydney NSW 2000 Australia +61 (0)2 8298 0700 Christopher.Mackinnon@lloyds.com

-

What woke you up too early this morning?

nbfiresprite replied to Tracy D'arth's topic in General Boating

That time of morning on a Monday, if traveling on the early morning coach from Poole, the coach would just be pulling into Heathrow Bus station to unload, before heading to London VCS. -

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

DWP Press Statement 7th Feb https://www.canalworld.net/forums/index.php?/topic/117072-boat-dwellers-to-be-able-to-claim-the-£400-energy-allowance/page/33/#comment-2899456 After confirming the payment schedule for five cost of living payments through the 2023/24 financial year, The Department for Work and Pensions (DWP) has today announced in Parliament more detail on the support. This includes estimates of how many people across the UK, and in each local authority and parliamentary constituency, will receive the first £301 Cost of Living Payment and the £150 Disability Payment, which follows on from up to £1,200 in support for low-income households in 2022. Work and Pensions Secretary, Mel Stride said: These direct payments will help people right across the UK over this year and the start of the next, as we continue to provide consistent, targeted and substantial support for the most vulnerable. Our wider support package, including the Energy Price Guarantee, will ensure every household is being helped through this challenging period of high inflation, caused by Putin’s illegal war and the aftershocks of the pandemic. Chancellor of the Exchequer, Jeremy Hunt added: High inflation, exacerbated by Putin’s illegal war, is hurting economies across the world and making people poorer. These payments are the next part of the significant support we are providing through this challenging time, with millions of vulnerable households receiving £900 directly into their bank accounts this financial year alongside additional help for pensioners and those with disabilities. This latest payment will provide some temporary relief, but the best thing we can do to help families and businesses is to stick to the plan to halve inflation this year. Exact payment windows and qualifying periods for eligibility will be announced in due course, but are designed to ensure a consistent support offer throughout the year. Payment windows will be broadly as follows: £301 – First 2023/24 Cost of Living Payment – during Spring 2023 £150 – 2023 Disability Payment – during Summer 2023 £300 – Second 2023/24 Cost of Living Payment – during Autumn 2023 £300 – 2023 Pensioner Payment – during Winter 2023/4 £299 – Third 2023/24 Cost of Living Payment – during Spring 2024 There are several benefits that could make claimants eligible for the £301 Cost of Living Payment, including Universal Credit and tax credits – through which 5.4 million households across the UK are expected to qualify, and Pension Credit, through which 1.4 million pensioner households are expected to be paid. 1.3 million will be eligible through legacy DWP benefits such as Jobseekers Allowance and Income Support, reaching a total of 8.1 million households. Eligible individuals do not need to apply for payments, as they are made automatically. Those eligible for cost of living payments through tax credits, and no other means-tested benefits, will be paid by HMRC shortly after DWP payments are made. This builds on the government’s wider support package, which includes further funding for the Household Support Fund, bringing its total value for October 2021 to March 2024 to over £2 billion. The fund is distributed to English councils, who know their areas best and are then able to offer direct support for those most in need in their local area. Every household with a domestic electricity supply is also benefitting from the Energy Price Guarantee, which is saving the average household around £900 this winter and a further £500 in 2023/24 by capping energy costs. Benefits will also rise in line with inflation from April, which will see a 10.1% increase for pensioners and those on the lowest incomes, whilst the National Living Wage will see its biggest ever cash rise, bringing it to £10.42 an hour. This all follows on from 2022’s support package, which included: A £650 Cost of Living Payment for means-tested benefit claimants, split into two payments, each of which supported over eight million households Further £300 and £150 payments, which reached over eight million pensioner households and six million disabled people respectively A £150 Council Tax rebate for all households in Council Tax bands A to D in England A £400 energy bill discount for all households, which will continue to run through March 2023 -

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

You get a secord payment in October 2023, a third payment in March 2024 -

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

Your local council does do the processing and payment for people who don't have a domestic electricity account and have to make a claim. As for automatic payments, this is processed by Whitehall and your electricity company. -

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

The other two were able to produce council tax bills with their name on it. With the others, the council tax bill for thier home address was not in their name. I'm also have to pay council tax on my mooring for the same reason, it is the way that the Anglia Revenues Partnership (ARP) deside if a mooring should be zoned for council tax. I have had a long term battle with them for a number of years on this subject, the funny thing is that they send the bill to my home address in Dorset. -

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

More a case of a quick and easy way to verifier that an address is residential when crossed checked with the national grid database. -

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

All three moorings are non-residential and post goes to elsewhere. They fall under the Anglia Revenues Partnership (ARP)( which processes council tax for West Suffolk) rule that require that you produce a council tax bill from another area with your name on it. -

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

Three so far (All pay council tax on their moorings), two were rejected for not being on the council tax database. -

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

Some of the moorers at the Riverside Island Marina on the River Lark in West Suffolk had their £400 and £200 payments today. -

Boat dwellers to be able to claim the £400 energy allowance.

nbfiresprite replied to Alway Swilby's topic in Living Afloat

Using the planning permission as a method to process application would be more than problematic, in view that anything built before the The Town and Country Planning Act 1932 introduced the concept of 'Planning Permission' into British legal history, would not have planning permission. Plus that records before 1990 (Average date for the introduction of PC's in councils) will only be on paper. Long process searching through boxes and boxes of records. Hence the used of the council tax database to process applications.